How Financial Planning Software Works

Retirement is a part of our journey in life that most of us take for granted or overlook. That is probably because we don't really look forward to it. As we turn a blind eye to our finances once we retire, there is an increasing chance that we no longer can support the kind of life we would want to have.

One of the most important things to focus on as retirement age nears is financial planning. While the term is familiar, most of us are actually clueless as to what it means. In order to fully understand how financial and social security planning works, the good news is that we have the convenience of using financial planning software. What is it and what can it do for you?

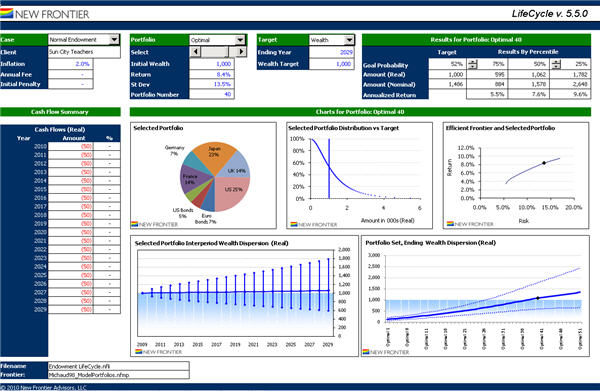

Social Security Planning Software, when installed on your personal computer, works like a separate computer that tracks your money, transactions, and all sorts of stuff related to how you do your finances. It gives you a warning when problems with money are beginning to appear. The programs running them usually track and display your spending, budget, savings, investments, banking, bills, debt, and retirement plans. And while you may have an entire cabinet full of these documents, the financial planning software puts them all in one convenient program.

Financial planning software is generally divided into two categories namely money management and tax preparation programs. Money management software focuses on offering functions like budgeting, banking, planning, investing, reports, and taxes. On the other hand, tax preparation programs usually incorporate planning, forms, importing, reference, error checks, deductions, and online planning.

Why Should You Use One?

The thing is you can actually track your finances without the help of any Retirement Planning Software. All you have to do is get a pen and a thick pad of paper. You can even use a Microsoft Excel spreadsheet if you want. However, once you've tried it you'll eventually realize how prone you are to mistakes and you end up wasting away your time.

Financial planning software on the other hand will help you organize your financial life in a manner that's quite easy to learn. But what's really more amazing is that you will be getting automatic updates of your financial data. Your day-to-day transactions involving your money will be tracked and recorded. So if you are to choose a pen and paper over sophisticated and very effective software for financial planning, it makes perfect sense if you choose the latter.